THE SECRETS OF SELLING A CELL SITE

Wireless Consulting Partners, LLC

Understanding why companies will bid how they bid is one of the more difficult analysis an average landowner will have to make during their time leasing a tower site. While selling an asset is not always the preferred choice, when they do make the decision to sell they want to be assured that they are receiving the highest value achievable.

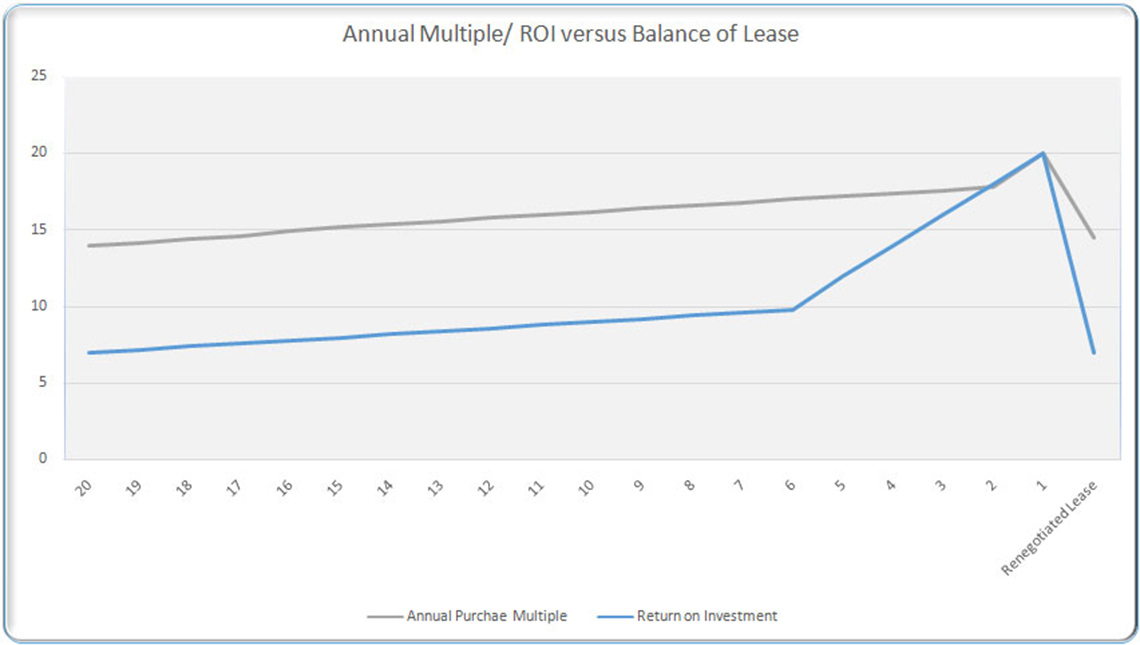

That is not always easy, as evidenced by the graph above. Investment groups will focus their attention on a certain rate of return (+/- variance in appetite) and merely factor in variables that – they alone – are aware of, not disclosing that information to the landowner, to drive up their rate of return after the acquisition.

If you look at the graph above, you can see the target ROI/multiple an investor may pay if you are in a 20 year lease. Assumptions are based upon a 3% annual escalator and a Tier 1 or Tier 2 Tenant. Notice how the both changes as you get closer to end of the lease.

An example would be a brokerage house that also acquires sites will often support a landowner in their endeavor to sell or negotiate a site. These groups will withhold how much they could get with a rent negotiation or a resale to benefit their acquisition. It is not unheard of to hear of people earning $100k-$300k commissions on one particular transaction-based relationship.Any by the way, the people earning this type of settlement is a SALESPERSON.

Believe it.

On the flip side, many landowners will often recognize that their lease multiple is increasing every year and feel that if they raise their rent that they will be able to not only increase their rent roll, but also that they will be able achieve the same “high” multiple once they raise their rent.

This creates an exaggeration in value that often causes a landowner to not realize a substantial opportunity presented to them.Once the lease is negotiated or extended the value of the sale (in multiple terms) resets back to the original value range.The reason for this is basically due to the lack of upside opportunity for the investor.

An example would be a landowner with a $500 monthly rent tower, with a multiple tenants.They get approached for a $100,000 sale opportunity and they figure that they are now receiving 200x in sale opportunity. They make the decision to renegotiate their lease and receive $800 in rent.Many landowners now erroneously believe that someone will now buy the site for $160,000 in sale price.

This is not the case.

Sadly, many landowners today are compelled to deal with the 3-5 companies that approach them monthly often taking 10’s of thousands of dollars less than they should.Additionally, once a landowner extends their lease they often are now closing the door from their ability to deal with an extended group of investors.

Once the lease is extended, they are now exposed to a smaller pool of investors and (sadly) are subjected to pricing models that include overhead, commissions, and expenses for the investment company.Reason being, the highest paying investors will always gravitate towards the sites with expiring leases.

At Wireless Consulting Partners we recommend taking a step back to understand how big this event could be. LFA currently shops tower assets to over 15 different investment groups, and ensures a landowner receives the highest value achievable.

Landowners… this value is yours… You wouldn’t walk down the street and give away $50k of your hard earned money.Don’t give it to the next big banker or smooth talking salesperson that calls your line.

*Pricing Multiples above can often be impacted by appetite of company, negotiation, and often timing of negotiation

Note

Wireless Consultng Partners, LLC. is a consulting firm focusing on cellular leaseholds. WCP. LLC. and its affiliates do not provide tax, legal or financial advice.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or financial advice. You should consult your own tax, legal and financial Advisors before engaging in any transaction.